Table Of Content

This will put them at the price point they can best afford and allow them to potentially prioritize their offer with sellers over other buyers, since they will be ready to close quickly. In this example, if your budget is $2,000 per month and rates rise to 9%, you might have to shop for a home with a lower price tag. Conventional mortgages are loans that conform to Fannie Mae and Freddie Mac underwriting standards. These are the most common mortgages that are not backed by the government.

1 adjustable-rate mortgages

For buyers with limited credit or finances, a government-backed loan is usually the better option as the minimum loan requirements are easier to satisfy. How much house you can afford comes down to a number of factors, including what you earn and what you owe. You’ll also want to consider how much you want to save for retirement, school and other expenses down the road. Going with the lowest rate might seem smart, given how much interest you pay over the life of a mortgage. But getting the right mortgage for your situation is also important. We focus first on understanding you and your goals, not just your finances.

Mortgage payment formula

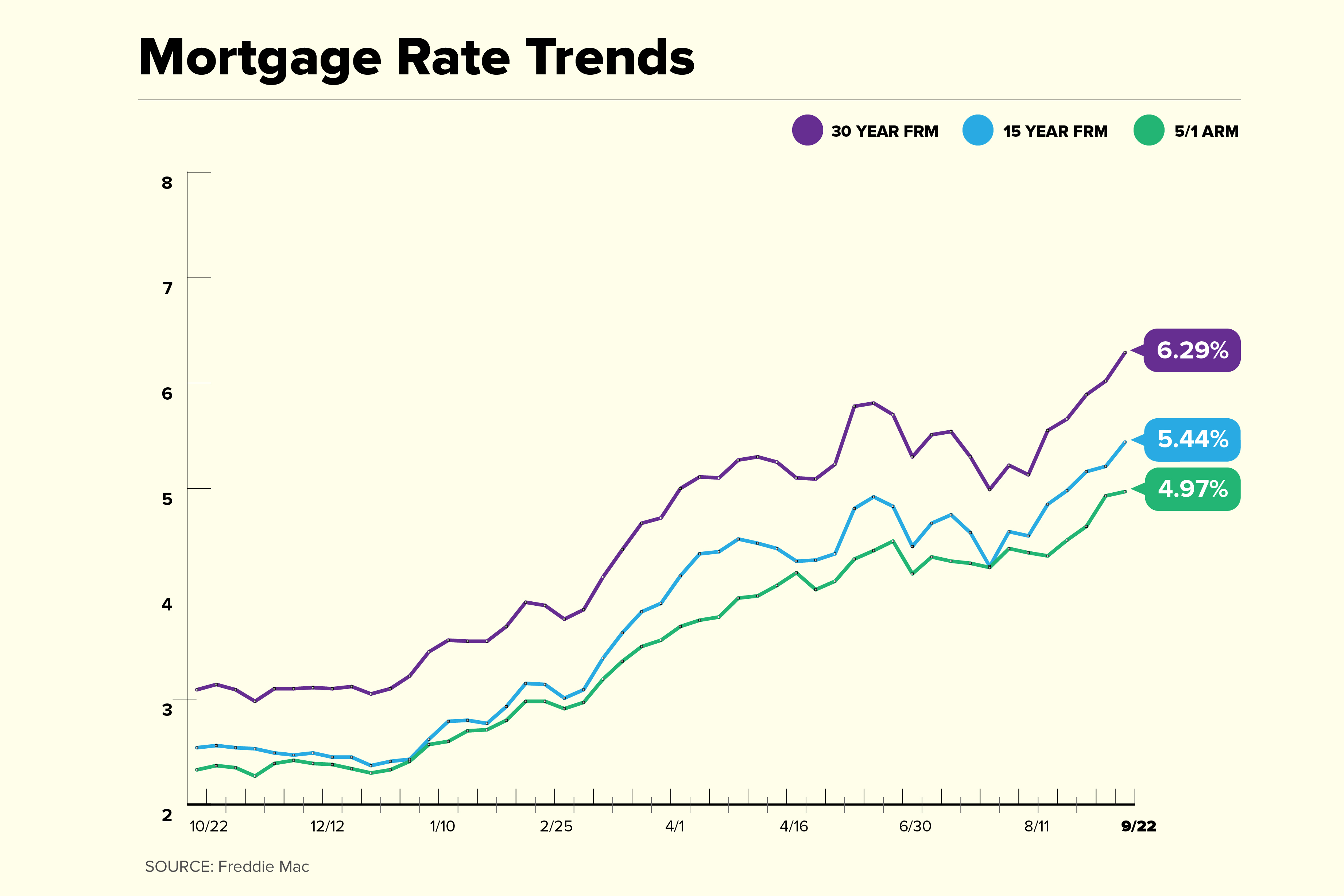

For example, on a 5-year ARM, the interest rate remains the same for the first five years, and then adjusts for the remaining term. Adjust the graph below to see historical mortgage rates tailored to your loan program, credit score, down payment and location. Once you find a rate that is an ideal fit for your budget, it’s best to lock in the rate as soon as possible, especially when mortgage rates are predicted to increase. While it’s not certain whether a rate will go up or down between weeks, it can sometimes take several weeks to months to close your loan. Federal Reserve raises its interest rate target for overnight lending between banks, and interest rates throughout the financial sector typically follow suit. From March 2022 to July 2023, the Fed raised its policy rate 11 times, leading to a surge in mortgage rates.

Mortgage terms and types

The first thing borrowers need to think about is what type of product they want. One is a fixed-rate amortizing loan, such as the common 30-year amortizing mortgage. The other is an adjustable rate mortgage (ARM) where the rate can fluctuate over time.

Mortgage options and terminology

Another is maintaining a debt-to-income (DTI) ratio below 43%, which implies less risk of being unable to afford the monthly mortgage payment. The Federal Reserve has been working to bring inflation to a more sustainable level of 2 percent. However, you have no idea what mortgage rates will be like once the intro-rate period ends, so you risk your rate increasing later. This could ultimately end up costing more, and your monthly payments are unpredictable from year to year.

How to get the lowest 30-year fixed mortgage rates today

Mortgage Rates Stay High Amid Inflation Fears - Bankrate.com

Mortgage Rates Stay High Amid Inflation Fears.

Posted: Wed, 24 Apr 2024 20:03:45 GMT [source]

This is because mortgage rates change based on investor demand for mortgage-backed securities, and this demand is often impacted by how investors expect Fed hikes to affect the broader economy. In response, 30-year mortgage rates jumped up further above 7%, according to Zillow data. Until inflation slows and the Fed is able to start lowering the federal funds rate, mortgage rates are expected to remain elevated. US mortgage rates increased to the highest level in five months, pushing down home-purchase applications for the fifth time in the last six weeks. Mortgage lenders generally watch the 10-year Treasury bond, which is tied to mortgage rates, and expectations that the Fed will keep rates high has pushed up Treasury yields. The 10-year Treasury yield has soared since the start of the year, now sitting at about 4.6 percent.

Current Mortgage Rates and How to Compare Offers - The Wall Street Journal

Current Mortgage Rates and How to Compare Offers.

Posted: Thu, 25 Apr 2024 16:00:00 GMT [source]

USDA loan (government loan)

A persistent housing shortage and a competitive housing market will continue to put upward pressure on home prices next year. These locked-in households haven’t relocated for better jobs or higher pay, and haven’t been able to downsize or acquire more space. Rates on new home loans now far surpass rates locked in by Americans with existing mortgages.

Conforming loans

However, be careful about giving up contingencies because it could cost more in the long run if the house has major problems not fixed by the seller upon inspection. Multiple factors affect the interest rate for a mortgage, including the economy’s overall health, benchmark interest rates and borrower-specific factors. Today’s 30-year mortgage—the most popular mortgage product—is 7.73%, up 0.12 percentage point from a week earlier.

Current Mortgage Rates by State

A 30-year fixed term comes with a higher rate than a shorter fixed term, and it’s higher than the intro rate to a 30-year ARM. You’ll also pay much more in interest over the life of your loan due to both the higher rate and the longer term. When the Federal Reserve lowers the federal funds rate, mortgage rates typically go down in response. However, according to the CME FedWatch Tool, there’s roughly a 95% chance that the Fed will not lower its rate at the central bank’s next meeting on May 1.

Your rate will be different depending on your credit score and other details. Let us estimate your rate and help you reach your financial goals. C.A.R.’s 2024 forecast predicts the U.S. gross domestic product to edge up 0.7 percent in 2024, after a projected uptick of 1.7 percent in 2023. Get a roundup of weekly economic and market news that matters to real estate and your business. All the info you need on California’s housing market, economy, and issues impacting the industry. On Friday, the US Bureau of Economic Analysis released personal consumption expenditures data for March, which showed that prices rose slightly faster than forecasted last month.

Those developments over the past month appeared to be the major catalyst for Freddie Mac’s big downgrade in its housing market outlook. The painful rise in mortgage costs is just one headache for households. Inflation spiked to a 40-year high of over 9% in the summer of 2022 and was running at 3.5% in March, well above the Federal Reserve's 2% target. That speaks to the rising cost of food, energy, rent, and other goods and services for consumers. Right now, 30-year rates are above 7%, which looks terrible compared to 2021, when you could lock in a rate at 3% or lower.

No comments:

Post a Comment